Lockdown 2.0 has impacted the industry, but requires context

With the introduction of a second round of national restrictions at the start of November, many retailers were undoubtedly nervous about how this would impact business for the remainder of the year.

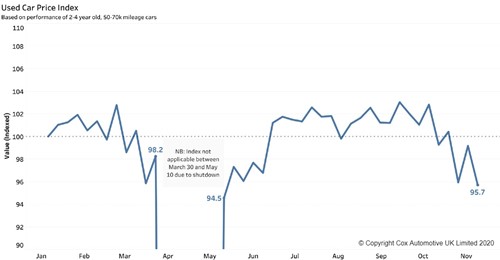

While the data shows an easing of used vehicle prices and consumer demand, it’s important to look at these figures in context. Used car prices were already decreasing in October, as was consumer demand, all before any announcement of a second wave of national restrictions was made.

As it stands, it’s unclear whether restrictions will be extended beyond 2nd December or not. Regardless, the investment in digital retail being made by automotive retailers, and the experience of the first lockdown in spring, has put businesses in a much better place to weather the storm this time round.

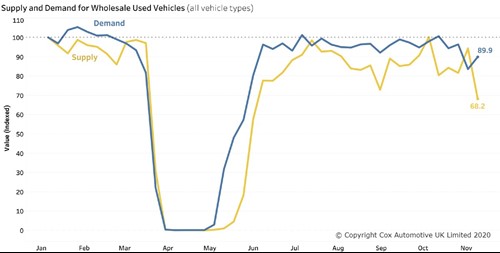

Used vehicle supply is down; much of this is seasonal

The constraint on vehicle supply has been much discussed over recent months—something that’s unlikely to change anytime soon—and the latest data shows that supply has once again dipped at the start of November.

Undoubtedly the introduction of a second round of national restrictions has played a part in the drop, but it’s important to remember that a supply dip around this time of year is perfectly normal.

In the wholesale market, vendors typically ease their auction activity ahead of the new year, but the easing has been compounded this year by reduced demand. Vendors are unsurprisingly cautious about entering vehicles into a weak marketplace.

A 6.41m used car market looks on track following Q4 easing

The market was in a strong place at the end of Q3 after a 4.4% year on year increase in used car transactions. Subsequent easing of supply and demand in the early stages of Q4 means a 6.41m used car market in 2020—as forecast in the latest Cox Automotive Insight Report—looks on track.

In the report we forecast 1.3m used car transactions in Q4 (-25%). Current supply and demand levels make this look like a realistic outcome, meaning the year could end -19.2% down compared to 2019.