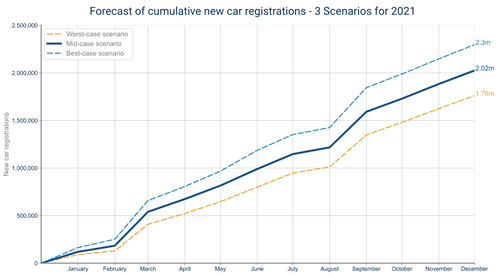

1) New car forecast for 2021

Our analysis has shown 2.02m new car registrations in 2021 is the most likely scenario, a fall of -12.8% against the 2001-2019 average. Our team has also developed projections for best-case and worst-case recoveries for contrast (2.29m and 1.76m, respectively).

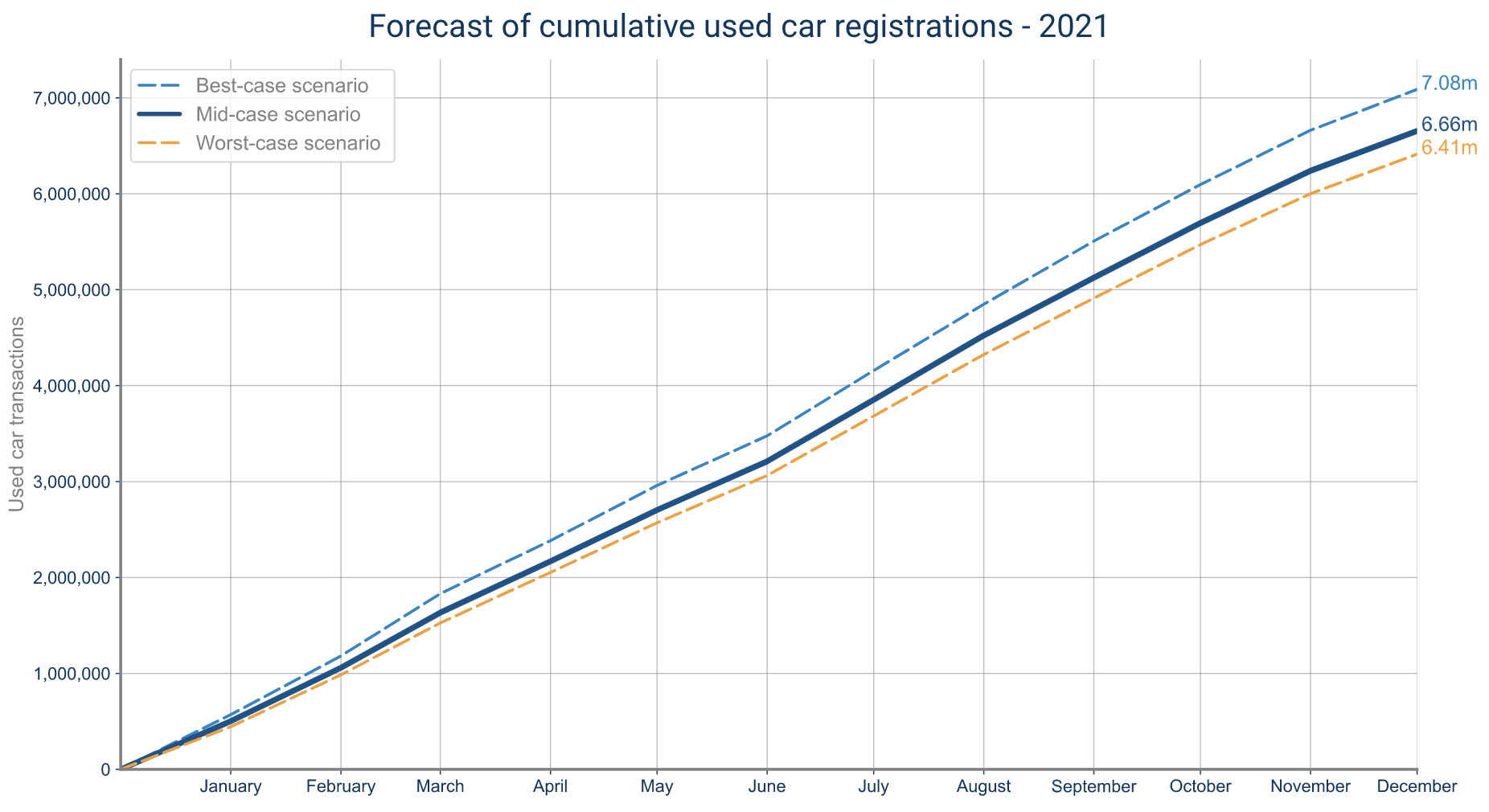

2) Used car forecast for 2021

With the used car market already in decline since the 2017 peak and restrictions throughout the year, we forecast a mid-level figure of 6.64m used car transactions in 2021. Best and worst-case outcomes range from 6.41m to 7.08m, depending on unknown factors such as the rate of economic recovery, unemployment, supply and more.

3) Investment in EV infrastructure is needed

In order to help meet the Government’s ambitious targets for electric vehicles in the UK, huge investment is needed in EV infrastructure to meet increased demand. Recent analysis from SMMT and Frost and Sullivan suggests 1.7m public charge points will be needed by the end of the decade and 2.8m by 2035 (SMMT, 2020)

4) Usership won’t succeed ownership anytime soon

As it stands, more than half (56%) of dealers in our recent survey felt there had been no significant shift from ownership to usership in the automotive sector. It’s no surprise then that two thirds (66%) of respondents have made no attempt yet to build a business strategy around the shift from ownership to usership.

5) ADAS really does improve safety

Most cars rolling off the production line today have some sort of Advanced Driver Assistance System (ADAS) fitted with the aim to improve driver safety. LexisNexis Risk Solutions analysed 11 million randomly selected vehicles equipped with certain ADAS features, revealing a 27% reduction in bodily injury claims frequency and a 19% reduction in property damage frequency.